In the years immediately following the COVID-19 pandemic, auto dealers experienced a paradigm shift in inventory management, pricing strategies, and overall business operational strategy. The unprecedented circumstances led to a period when inventory acquisition was viewed as a “get it however you can” mentality. However, as the market dynamics for supply chains have reverted back to more prepandemic conditions, combined with a still-challenging economy, dealers find themselves facing new challenges. Now more than ever, it's imperative for auto retailers to return to a prepandemic mindset, where they were hungry and searching for the right competitive edge in their approach to inventory management and pricing strategies.

The pandemic significantly altered consumer behavior. From remote work setups to reduced travel, the demand for certain vehicle types fluctuated. Auto dealers had to adapt swiftly to these changing preferences. Overpaying at auction might have been overlooked by a forgiving market, but now, any missteps are swiftly punished. As the economy stabilizes, it's essential to reassess these shifts and realign inventory accordingly, leveraging advanced data analytics to gain a competitive edge locally.

During the peak of the pandemic, many auto dealers quickly shifted their focus to inventory acquisition and management, acquiring cars and trucks regardless of the cost of acquisition. Dealers knew they could make up the profit upon resale simply because supply was also low for customers. This dramatically reduced supply, coupled with increased demand and shifting manufacturers' incentives, led to this approach to inventory management, ultimately bringing significant profits to dealers.

Many Dealers Complacent

However, this philosophy is not sustainable in the current economic climate and industry, yet many dealers remain torpid in their need to re-evaluate their approach, to regain a willingness to scrutinize every little aspect of inventory acquisition.

With the economy and supply chains stabilized, competition among auto dealers is again intensifying. Dealers who focus on proactive inventory management and pricing strategies are now better positioned to meet the changing market dynamics. And this means those who continue to rely on the pandemic-induced philosophy of acquiring inventory will soon find themselves at a disadvantage.

Regaining a Competitive Edge

Efficient inventory management is still one of the key cornerstones of success for auto retailers. It's crucial to strike a balance between stocking sufficient inventory to meet demand and avoiding overstocking, which can lead to financial strain. By analyzing sales data and market trends, dealers can optimize inventory turnover and minimize carrying costs. Today, only 12.6% of retailers are believed to be leveraging sophisticated analytical data to monitor days on the lot, combined with segment type, used or new, and other local inventory levels of similar vehicles, according to a Lotlinx survey in March of more than 2,500 auto retailers.

This expanded view of inventory trends can separate good dealers from great dealers.

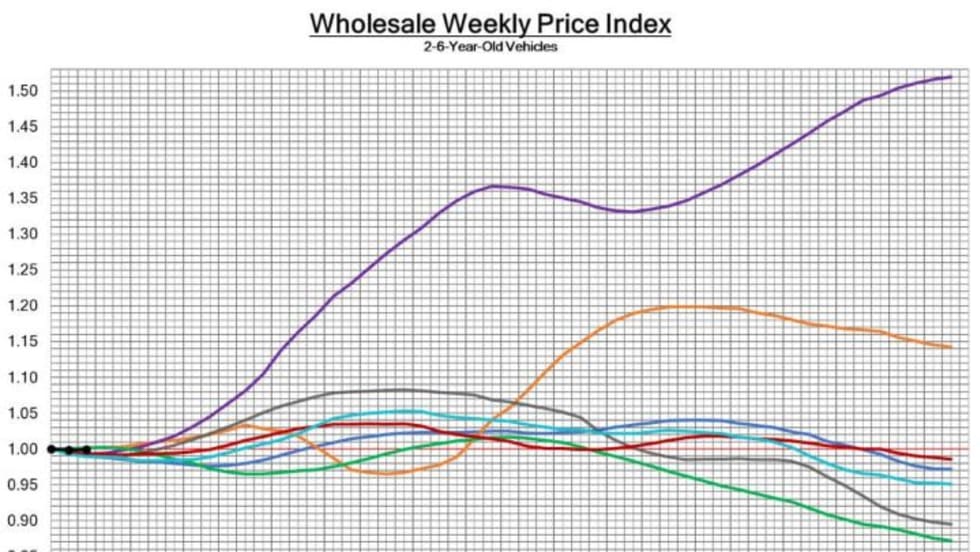

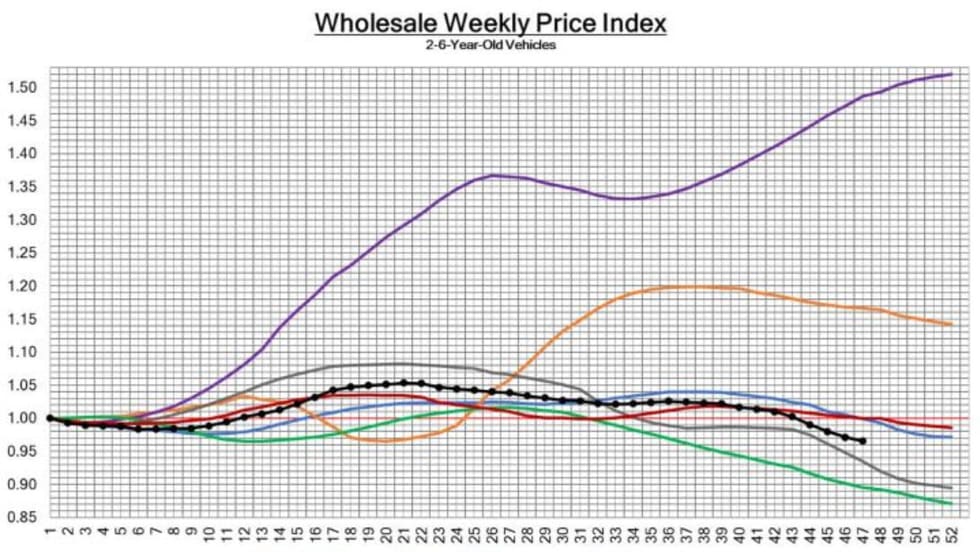

Furthermore, dynamic pricing strategies now enable dealers to adjust prices in real time based on factors such as demand, market conditions, and competing local inventories. During the pandemic, some dealers may have resorted to static pricing due to reduced competition. However, in today's competitive atmosphere, dynamic pricing is essential for staying agile and maximizing profitability.

Technology also plays a pivotal role in modern inventory management and pricing strategies. Dealers should leverage inventory-management software, artificial intelligence and predictive analytics, and pricing tools to streamline operations and make data-driven decisions. These tools provide insights into market trends, customer preferences, and competitor pricing, empowering dealers to stay ahead of the curve.

Beyond inventory management and pricing strategies, delivering exceptional customer experiences remains paramount. In a competitive market, satisfied customers become loyal advocates and repeat buyers. Dealers should prioritize transparency, responsiveness, and personalized service to foster long-term relationships and drive sales growth. During the pandemic years, many dealers absorbed an attitude of “the customer needs us more than we need them.” While some dealers still operate under this mindset, leading dealers understand they need to work to earn the customer’s satisfaction and long-term trust.

As the automotive industry navigates this post-pandemic time and shifting economic climate, auto retailers must continuously re-evaluate their inventory management and pricing strategies. By returning to smart fundamentals and embracing proactive approaches, dealers can adapt to the evolving market dynamics and thrive in the competitive environment.

Len Short is executive chairman of Lotlinx, which offers an inventory platform.

EDITOR’S NOTE: This article was authored and edited according to F&I and Showroom editorial standards and style. Opinions expressed may not reflect that of the publication.