When I started gvo3 & Associates a quarter-century ago, it was one of two auto-compliance companies. Rob Cohen did great work in California with DMV regulations and advertising reviews. gvo3 focused on bank fraud, deceptive practices, and forms audits. The best practices at the time spawned today’s cautionary forewarning: “What were once best practices are now felonies.”

Rob was smart and sold his business. We are now 10 associates strong and added several auditing touchpoints to support every new regulation or risk. And the compliance consulting business must be good because there are now a lot of new companies branding themselves as compliance auditors.

Some companies will simply provide a forms audit, and others will audit the processes on their compliance checklists. Few will also review for bank fraud, identity theft, deceptive practices, the paper trail, forms and the proper execution thereof. Still fewer use auditing as a core competency to provide consulting solutions so dealers can continually improve their compliance quotient.

When you are vetting partners to assist in your risk-management solution, you need to know the difference in the output you will receive. You need an in-depth compliance risk assessment, training and solutions, including three critical components:

Forms Audit

This audit is something a sixth grader, or AI, can do quite easily. Our checklist has 78 forms that may be in the deal depending on whether it is a retail, lease or cash transaction, and if it was recontracted.

In this audit, the sixth grader takes the deal jacket and the checklist. Then, one deal document at a time, he or she determines what the form is, finds the corresponding form on the checklist, and puts a checkmark in the box next to the form.

An AI-driven forms audit essentially does the same thing with a digital file and the push of a button.

In a few seconds, the user is given a report with a list of missing forms. This type of audit doesn’t require any critical thinking and should be dirt cheap.

Compliance Checklist Audit

Our clients employ a three-level auditing process: each deal, a monthly sampling, and an independent review.

Using a compliance checklist, the F&I manager and billing clerk review every deal file for a list of important compliance requirements in the primary level. Examples of tasks to be checked include:

Red flags have been properly cleared.

Signatures are on all documents.

The menu base payment matches the final pencil.

The terms on the accept-decline match the contracts.

A huge focus must be on the paper trail: pencils, menu, contracts and voluntary protection product forms. Ensure that the math flows and every price point has the consumer’s consent to purchase.

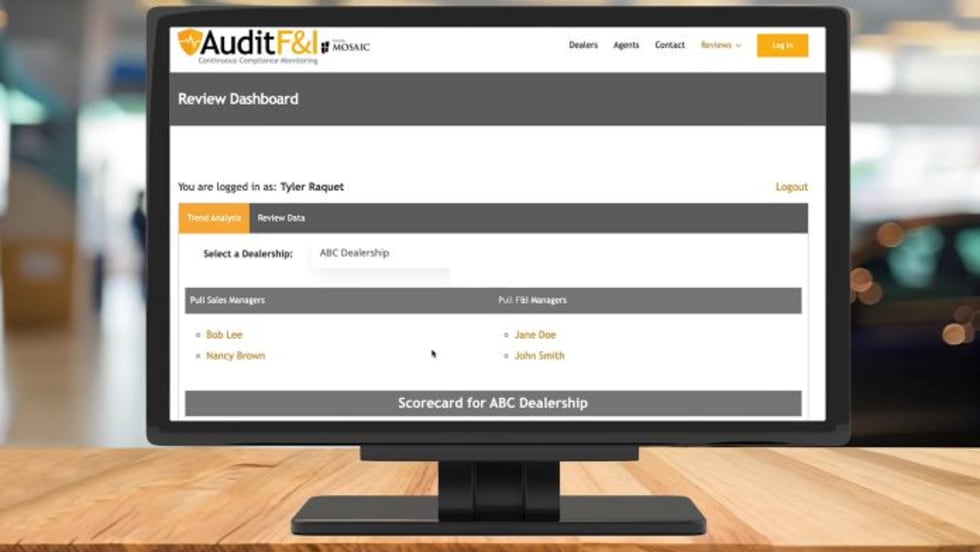

This audit is more intensive than a simple forms audit. It requires humans to dive into the forms for compliance. I’m only aware of one firm that offers a software solution to complete a compliance checklist audit.

The monthly audits are conducted on a sampling of deals for each F&I manager by the dealership’s compliance officer, controller or general manager. This audit, though, is only as good as your compliance checklist.

In-Person Review

By far the flagship of compliance audits is the in-person professional compliance review. The goal is to touch or review every piece of paper in the deal from the vantage point of a member of the Dark Side who is attacking the dealer. After all, the best way to defeat your enemy is to know your enemy.

This is more of a forensic review than a document-completion audit. To be effective, it must be completed by a human with a critical eye and an understanding of the documents generated on the road to the sale.

Only after understanding the risks presented by the forms execution can a company provide a thorough consultation to assist the dealer in improving its best practices and processes. The ultimate goal is that the deal jacket is the dealer’s best defense witness, not a manager who may no longer be with the company to testify.

Continued good health, good luck, and good selling.

Gil Van Over is executive director of Automotive Compliance Education (ACE), founder and president of gvo3 & Associates, and author of “Automotive Compliance in a Digital World.”